Financial literacy is something that young people can find difficult to grasp. From saving money to spending it wisely, teens tend to be unaware of how to properly manage their finances so that they’ll be properly prepared for the future. The National Academy of Finance is a new program at Eleanor Roosevelt High School that allows students to go in-depth on how to be financially responsible now and in the future. The NAF program contains a series of classes that offer opportunities for future business owners, such as internships and curricula that empower students to confidently choose their own future path.

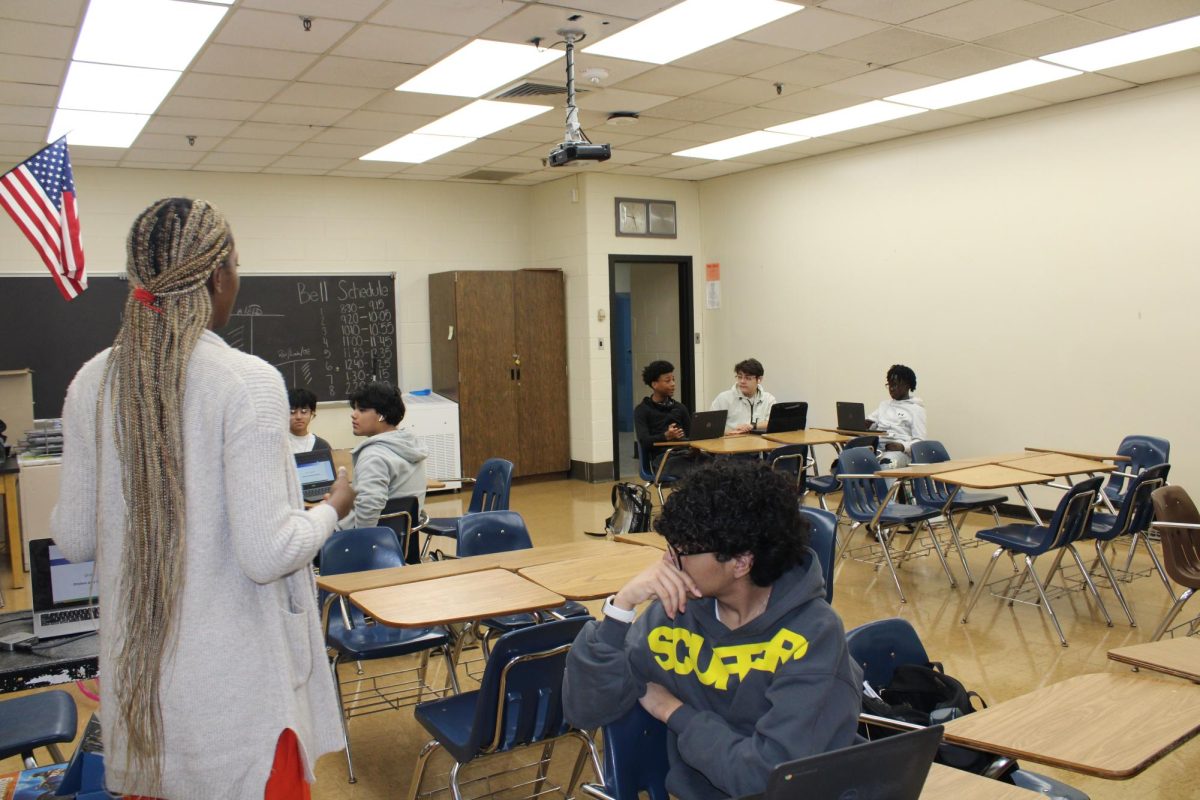

Ms. Kedeisha Charles, a Principles of Finance and Financial Planning teacher at ERHS, has 12 students currently in the National Academy of Finance. The NAF, a career and technical organization that “connects students to the world of finance through a curriculum that is very diverse,” states Ms. Charles, is intended to create career-ready students so that “they have the expertise to go into the real world.” This program is very well-renowned, with a 99% senior graduation rate and with 65% of NAF seniors reporting that they feel fully prepared for the workforce, according to the NAF official website.

There’s a multitude of requirements that need to be met to be a part of the NAF program, “…they go through a number of courses, about 8 courses over [4 years]” explains Ms. Charles. There are projects and internships that students have to participate in over the course of the year, with them having to “partner with local businesses in Grade 11.” Incoming 9th graders are able to enter high school under the NAF curriculum, however, students are still able to join the program for 10th grade. Keeping in mind that students have to take around 8 courses to meet their NAF requirements, it is not encouraged for students to join after 10th grade, as teachers and staff don’t want to put students in a position where they cannot complete the courses in time for graduation.

Nathaniel Lambkins, a freshman who is taking part in the National Academy of Finance program, states that he knows that “[he has] very poor money management skills,” and adds on how the program helps him “set realistic goals”. Often, we struggle with money management skills. Nathaniel expresses this by recalling a particular lesson where his teacher, Ms. Charles, “gave situations where we could go into detail about which one would be the best for their situation”. This program offers real-life scenarios in which students can display money-management skills in real time.

Like many programs here at ERHS, their goal is to make sure that students are prepared for the future by providing skills and opportunities that most don’t get to have at this time. Skills such as networking, time management, project management, and even simple but important skills like reading and mathematics. The NAF is no different, with 90% college-bound graduates and 81 thousand graduates in their alumni network. This program is definitely something that students should consider taking part in. With great staff working to maintain the program, and many students currently taking advantage of the opportunities that it presents, there is no harm in finding out if this program is the best for those who are interested in business, as Ms. Charles “would feel satisfied if [she knew] that these students can handle themselves from a financial perspective when they leave here.”